mississippi income tax payment

The tax rates are as follows. How Much Should You Pay in Mississippi State Tax.

Solved Wisconsin Credit For Taxes Paid To Another State

0 on the first 4000 of taxable income.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NBECF33QPZGYFHMT26IWYT363M.jpg)

. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Box 23058 Jackson MS 39225-3058. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

You will be taxed 3 on any earnings between 3000. How you can file your return. The graduated income tax rate is.

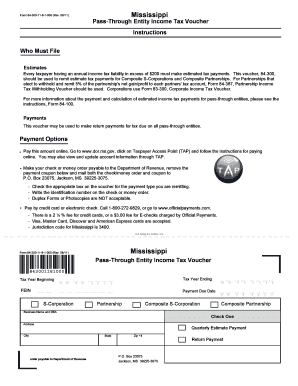

Income Tax Estimate Payments. Mississippi Department of Finance and Administration. Printable Mississippi Income Tax Form 80-320.

These local taxes bring the total sales and use tax rates that can be charged by local taxing jurisdictions to as much as 1025. 4 on the next 5000 of taxable income. 0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make.

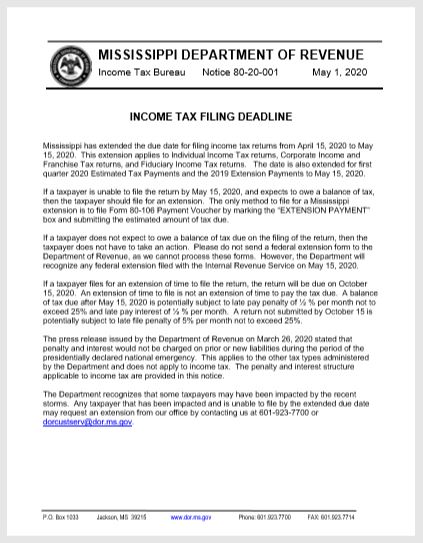

Box 23050 Jackson MS 39225-3050. Payment can be delayed until April 15th. If you underpaid or failed to pay your estimated income tax for the.

Mississippis income tax rate is 5. You can make payments for billings audits and other. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

How to Make a Credit Card Payment. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Hurricane Katrina Information.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Select Make an Estimated Payment from the left hand menu. Mississippi Income Taxes.

All other income tax returns P. WASHINGTON Victims of the water crisis beginning August 30 2022 now have until February 15 2023 to file various individual and. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

You can make Estimate Payments through TAP. Mississippi has a graduated tax rate. If you underpaid or failed to pay your estimated income tax for the previous tax year you must file form 80-320 to calculate and pay any.

If you are receiving a refund PO. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. You can pay online through TAP Direct deposit of individual income tax refunds is only available for e-file returns.

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. SBAgovs Business Licenses and Permits Search Tool. Eligible Charitable Organizations Information.

Because the income threshold for the top. 3 on the next 1000 of taxable income. 5 on all taxable income over.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Yes income paid to a member of the armed forces as additional compensation for hazardous duty pay in a combat zone designated by the President is exempt from Mississippi Income. 80-106 - Mississippi Individual Fiduciary Income.

MS-2022-01 September 2 2022. The bet Republicans are making in essence is that Mississippians will spend the income tax money theyre saving them in other ways and that other tax collections will rise. Payment Voucher and Estimated Tax Voucher 80106218pdf Form 80-106-21-8-1-000 Rev.

Its a flat rate which. The graduated income tax rate is. These rates are the same for individuals and businesses.

There is no fee. Combined Filers - Filing and Payment Procedures. Taxpayer Access Point Payment.

Welcome to The Mississippi Department of Revenue. There is no tax schedule for Mississippi income taxes. Mailing Address Information.

Mississippi Lawmakers Pass Largest Ever State Income Tax Cut The Dispatch

Income Tax Elimination Would Benefit Mississippi Seniors

Fiduciary Income Tax Return Mississippi Department Of Revenue Fill Out Sign Online Dochub

Mississippi Tax Rate H R Block

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms Fill And Sign Printable Template Online

Mississippi Dor Reminds Taxpayers That Income Tax Returns Are Due May 15 Cooking With Salt

Mississippi House Passes Tax Reform Proposal That Includes Phasing Out State Income Taxes

House Passes Mississippi Tax Freedom Act Of 2022 Mississippi Thecentersquare Com

Mississippi Governor Signs State S Largest Income Tax Cut Ap News

Can Mississippi Afford To Raise Teacher Pay And Eliminate The Income Tax Mississippi Today

Mississippi Good News For Residents Of Mississippi Lawmakers Pass State S Largest Ever Income Tax Cut The Economic Times

Mississippi State Tax H R Block

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Tax Commission To Make Change For Correct Sales Tax Payment 2 Coins Ebay

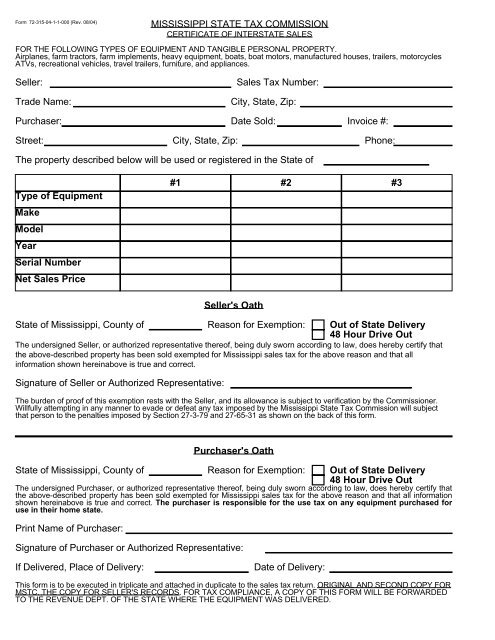

Mississippi State Tax Commission Seller Sales Tax Number

Mississippi Income Tax Cut House Senate Pursue Separate Tracks

Income Tax Phaseout Up For Debate In Long Poor Mississippi Abc News